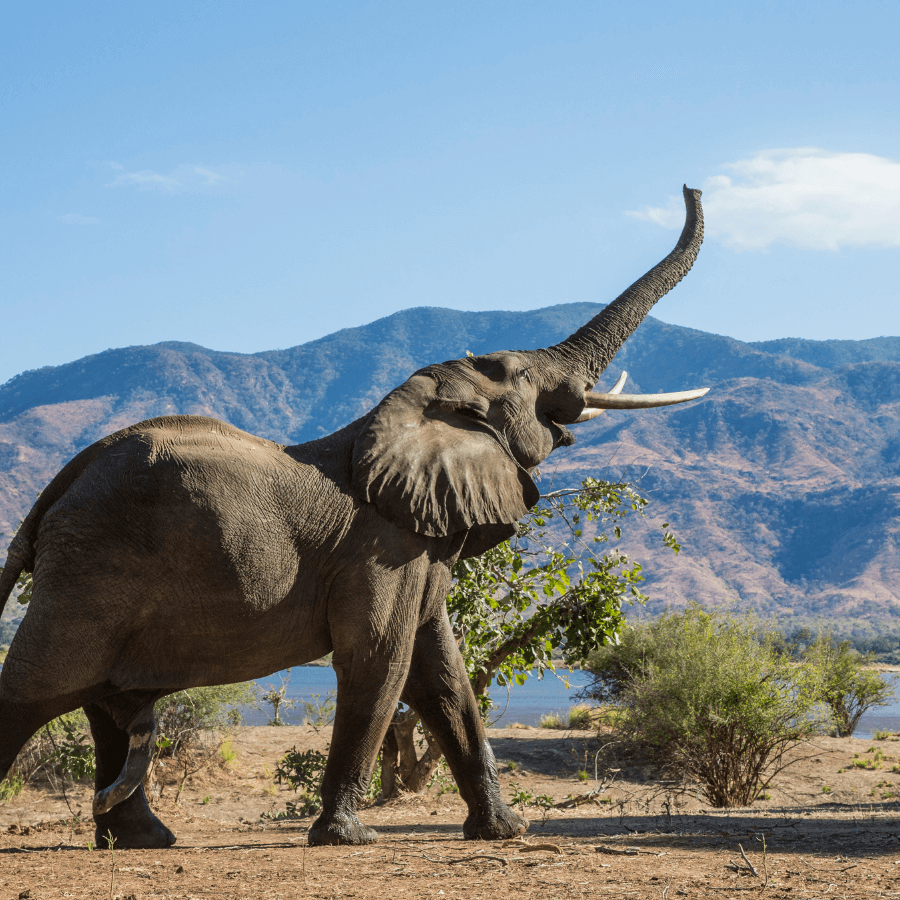

HOW TO EAT AN ELEPHANT

With ever-bloating drug plan costs, sponsors need bite-sized solutions to get costs under control

“Drug plans unsustainable.” “Biologics can cost thousands per year.” Headlines like these are enough to make plan sponsors lose their appetite. Employers are justifiably overwhelmed as they watch their drug plan costs rise to elephantine proportions. And they are equally overwhelmed when they investigate potential solutions: managed formularies, mandatory generic substitution, tiered coinsurance, mail order, provider networks and a host of other creative strategies—all promising results.

To say that the world of prescription drugs is complex is an understatement. When faced with making decisions that may affect their employees’ health and well-being, many employers experience “paralysis by analysis” and opt to put off changes even when they are sorely needed. Inaction is not a solution in an economy where profit margins are often flat or declining. Expensive new drugs will continue to enter the market. Employees will age and develop illnesses, and costs will continue to rise. At some point, drastic action may be necessary to “stop the bleeding,” potentially resulting in blindsided and disgruntled employees. So how do you eat an elephant? One bite at a time. This old adage applies well to the drug plan dilemma. Employers faced with myriad options need only start small.

Drug utilization analyses provide a baseline of plan performance. Then, basic plan design changes— implemented with minimal disruption and communicated effectively—can have an immediate impact on rising plan costs. More importantly, small changes now will make it easier in the future to implement more complex cost solutions.

Here are five bite-sized drug plan changes that every plan sponsor should consider.

- Pay-direct Drug Card

Fears of runaway utilization and loss of the “shoebox” effect (the idea that employees who are required to submit paper claims will toss them in a shoebox intending to submit them later only to forget to do so, thus saving the sponsor money) still make many employers feel they cannot afford to implement a drug card. In reality, they can’t afford not to. It’s true that, at least in the beginning, a drug card may increase drug plan usage regardless of where in Canada the employer’s staff and retirees are located. The resulting costs will vary depending on demographics and income levels. However, these costs will be more than offset by the savings resulting from improved cost controls and possibly lower adjudication costs (depending on the plan).

In the absence of electronic claims adjudication, it’s difficult to implement simple plan design changes, and complex changes—such as managed formularies— are virtually impossible. Paperbased claims are also adjudicated manually, which inevitably results in human error. And many pharmacies have begun charging a premium to cash-paying customers in the form of significantly higher drug markups. Since many insurance providers reimburse paper claims at face value, the plan sponsor pays the inflated price.

Pharmacies’ markup on prescription drugs, which is charged to all customers, is often higher than the markup agreement they have established with pharmacy benefits managers. The higher markup is submitted to the plan and will be “cut back” with a drug card. However, if the patient pays cash, he or she is charged the full markup. And when the paper claim is processed, not all carriers cut it back; it is often paid on face value. Twenty percent of plan sponsors still do not use a pay-direct drug card, according to Mercer estimates, despite being encouraged to do so. As a result, they have limited options when it comes to managing costs.

- Percentage Coinsurance

Mercer estimates that 35% of private benefits plans in Canada shoulder 100% of their drug costs—the employee pays nothing at the pharmacy counter. A percentage co-insurance shares a small amount of the cost burden with the employee, resulting in plan savings for the sponsor. More importantly, however, it serves to increase smart consumerism and engage employees in cost management. Prescription prices vary widely from pharmacy to pharmacy, which could motivate employees to shop around to reduce their out-of-pocket expenses and get the best professional services for their money. In addition, since generic prescriptions are sometimes 75% less than the brand cost, employees will gravitate toward—and may even request—generic drugs.

- Mandatory Generic Substitution

Maybe it’s the word mandatory, but contemplating this plan design change still worries some employers. However, mandatory generic substitution will soon emerge as a plan standard. This feature ensures that plan sponsors are paying the generic equivalent price, regardless of the brand prescribed or dispensed. There are exception processes to allow for brand coverage in those rare situations when it is medically necessary. Given that the cost of many generic drugs in Canada currently hovers at about 25% of the cost of the brand product, the benefit of this plan design feature should not be open to debate. The Ontario Public Drug Program, Canada’s largest provincial drug plan, has had mandatory generic substitution in place for many years with no untoward effects.

- Provincial Co-ordination

Several provinces in Canada offer universal drug coverage. In those provinces, it’s essential that employers confirm their insurance carrier’s approach to co-ordination. For example, B.C. offers comprehensive coverage for residents through BC PharmaCare. For eligible drugs, the province is the first payer once the annual deductible under PharmaCare is satisfied. For some drugs, approval through the province’s special authority program is required prior to the drug being covered. If this application is not submitted and approved, the province will not cover any amount for that drug. Ensuring that employees are registered for PharmaCare and apply for special authority coverage (when applicable) is important so that the employer’s plan doesn’t pay more than its share.

All provinces in Canada have public drug coverage available, whether universal or catastrophic or for special diseases. It’s essential to confirm that an employer’s plan design accounts for this and coordinates claims when appropriate.

- Prior Authorization

High-priced drugs (e.g., biologics and other specialty products) are a growing concern for employers. These drugs are used to treat a limited number of health problems, including rheumatoid arthritis and Crohn’s disease. Yet according to the 2012 BioInsight study, they may account for 20% or more of total drug plan costs—and this figure is increasing. Furthermore, biologics cannot be genericized. When less-expensive versions (known as subsequent entry biologics) are marketed, they are not interchangeable without the physician’s approval.

That said, some high priced drugs will have a significant impact on an employee’s health and well-being, restoring his or her work productivity and reducing disability costs. These drugs are a critical part of any drug plan, but due to their significant cost, employers must manage them appropriately. Insurance carrier prior authorization processes may be complex and not always patient friendly, but contrary to popular belief, they do not prevent patients from accessing needed medication. They simply ensure that the drug is being properly prescribed (according to the guidelines set by Health Canada) and that less expensive products—which may be equally effective—have been tried first. Prior authorization is the cornerstone of managing the cost of high-priced drugs, so employers should implement this before turning to other methods.

So how was that elephant? A bit easier to digest in small bites?

Solutions for drug plan management are emerging almost daily: some are innovative, but many have simply been repackaged and given a creative name. Employers should make it their responsibility to examine these options to understand whether, and how, they might benefit their drug plan. However, it is a sad fact that a significant number of plans in Canada today remain open and virtually unmanaged. Regardless of how well these plans currently perform, they are almost certainly not sustainable in the long term.

Does your drug plan fit this description? If so, tuck in your napkin and take that first small bite. -Alan Kyte

EMPLOYERS WORRY ABOUT HEALTH CARE COSTS AND MENTAL HEALTH

Controlling healthcare costs is the top benefits priority of Canadian employers for 2014—along with addressing mental health issues, a survey reveals.

This year, as many as 68% of companies worry about healthcare costs for 2014, up from 45% last year, according to Morneau Shepell’s annual survey on compensation trends and projections.

“This is a real jump off the page,” Joy Sloane, partner at Morneau Shepell, said, speaking at a seminar in Toronto where the survey was unveiled. This is the highest number on record, she added.

Another benefits priority for Canadian firms next year will be disability management (45% of respondents). This is followed by issues such as the competitiveness of benefits offerings (32%), benefits plan design (27%) and benefits plan administration (21%).

Specialty drugs

When it comes to costs, one field employers need to pay close attention to is the projected rise of specialty drugs—high-cost medications used to treat rare and complex conditions. Although specialty drugs are used by less than 5% of employees, they make up 15% to 25% of the total drug spend, according to research by Towers Watson.

In recent years, drug costs have plateaued due to the rise of generics, but pharmaceutical companies are not planning to issue them as much in the future, Sloane explained. “The drug markets are focusing on releasing specialty drugs because that’s where they get more return on investment,” she said.

To address the costs associated with specialty drugs, employers need to “focus on conditions that have modifiable risk factors” such as diabetes, high cholesterol levels and depression, Sloane said in an interview. Once they educate their employees about managing their personal risk factors through healthier lifestyles, companies will free up resources in their benefits plans for conditions whose risk factors are not modifiable, such as multiple sclerosis and arthritis, Sloane explained.

Although cost is an issue for Canadian companies,15% have improved their healthcare programs over the last couple of years, and 10% plan to introduce improvements next year, according to the survey.

Mental health

Another benefits priority that is receiving a lot of attention from employers is mental health—a leading cause of absenteeism in the workplace.

Figures by the Canadian Mental Health Association (CMHA) reveal that 20% of Canadians will experience some form of mental illness in their lives, and about 8% of adults will experience major depression.

But nearly half of those who feel they have suffered from depression or anxiety have never seen a doctor about their problem, according to the CMHA.

As a result of the growing awareness about the pervasiveness of mental illness, more than 40% of Canadian companies plan to train managers about mental health next year, according to Morneau Shepell’s survey. The goal of these training initiatives is to reduce the costs related to mental illness.

The Canadian private sector’s annual spending on mental health amounts to $180 billion for short-term disability benefits and $135 billion for long-term disability benefits, according to a 2010 report by the Institute of Health Economics, an Alberta-based nonprofit. The annual absenteeism and presenteesm costs stemming from mental health illness are estimated to be $6.3 billion.

Apart from mental health training, some Canadian firms (one-third) plan to introduce mental health policies next year, according to the compensation survey. This is in response to the new voluntary National Standard for Psychological Health and Safety in the Workplace, a recommendation developed by the Mental Health Commission of Canada, a nonprofit created by the federal government.

“It’s voluntary at this stage, but we do understand that it may not be in the future,” said Marilynne Madigan, managing partner at Morneau Shepell, speaking at the trends survey seminar. “Providing [mental health support] as a non-cash benefit is very relevant to today’s issues: attraction, retention and cost management.”

Conducted this summer, Morneau Shepell’s survey polled more than 300 Canadian organizations employing nearly three million people. The companies are mostly from the manufacturing, services and finance sectors. -Yaldaz Sadakova

TOP EMPLOYEE HEALTH RISK: SEDENTARY LIFESTYLES

Twenty-four percent of Canadian employers say work-related stress and sedentary lifestyles are the top major health risks affecting their employees, according to the Sun LifeBuffett National Wellness Survey.

An aging workforce coupled with the introduction of a younger generation of workers has businesses taking a closer look at what they are doing to support the well-being of their employees.

Noticing an increase in lifestyle related health conditions and the opportunity for illness prevention, many companies are seeing the need to invest in the health of their employees.

“With an increase in illnesses relating to both stress and sedentary lifestyles, the need for employer sponsored wellness programs is growing rapidly,” says Lori Casselman, Sun Life Financial’s assistant vice-president, health and wellness, group benefits.

Ninety-two per cent of organizations surveyed recognize that the health of their employees influences overall corporate performance.

The survey also finds that 62% of organizations currently offer wellness initiatives with 51% reporting an increase in employee morale and a 40% decrease in absenteeism. -BenefitsCanada